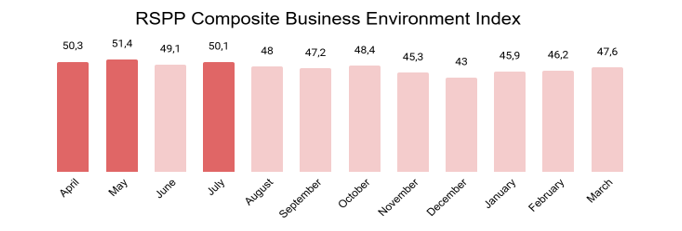

The Russian Union of Industrialists and Entrepreneurs (RSPP) conducted another round of surveys among industrialists and entrepreneurs in March 2025. The composite Index rose to 47,6 points, up 1,4 points from the previous month.

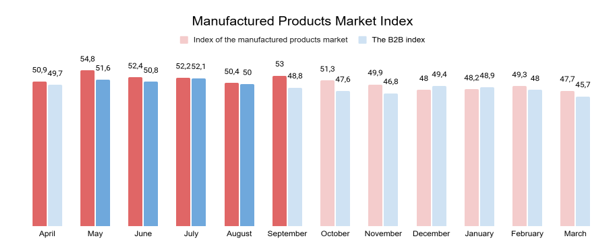

The Index for the market of manufactured products fell 1,6 points to 47,7. In particular, indicators for demand in the industry and for companies' own products/services, which had returned to the positive assessment zone last month, failed to sustain their position—their values equalized at 48,1 points. Accordingly, the assessment of demand in the industry decreased by 2,4 points, while the assessment of demand for companies' products or services dropped by 4,1 points.

The B2B Index showed negative dynamics, decreasing by 2,3 points to 45,7 points.

New orders showed little change: 65,4% of companies gave neutral responses, one-fifth of surveyed enterprises reported an increase in new orders, and 14,4% of companies saw a decline.

Companies faced greater difficulty in meeting their obligations to counterparties, compared to the previous month: this component of the Index stood at 46,4 points, down from February's 51,1 points. The indicator for "fulfillment of obligations by counterparties" also shifted negatively, dropping by 2,5 points to 38,5 points.

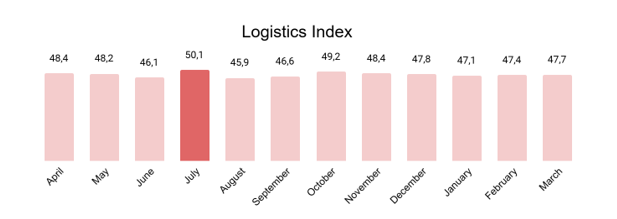

The Logistics Index reached 47,7 points, with a marginal monthly increase of 0,3 points.

Warehouse inventory levels held steady at 72,1% of organizations; one-fifth of enterprises reported an increase, while 8,7% saw a decrease.

The "average delivery time" indicator stood at 41,8 points (+0,5 points). 80,8% of respondents reported no change in delivery times for their companies. For 17,3% of organizations, delivery took longer than in the previous reporting period. Only 1,9% of enterprises managed to deliver products faster than a month ago.

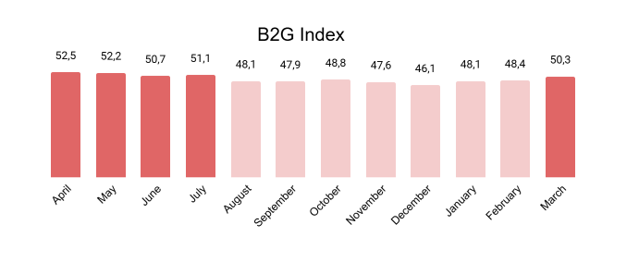

The B2G Index moved into the positive assessment zone with a value of 50,3 points, rising by 1,9 points on the scale.

This growth reflected improvements in two key indicators: the dynamics of business relationships with financial institutions and foreign partners.

The "business-government relations" indicator, in turn, maintained its value at 53,4 points.

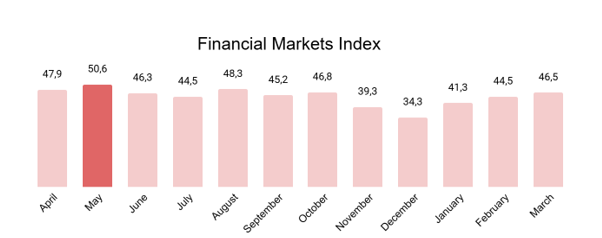

The Financial Markets Index stood at 46,5 points, up by 2 points compared to February's results.

The positive dynamics of the Index were attributed to growth in the indicators for "state of stock and currency markets." The former rose by 2,6 points to 48,8 points, while the latter increased by 3,2 points to 47,8 points.

The "financial position of companies" indicator remained unchanged at 42,8 points.

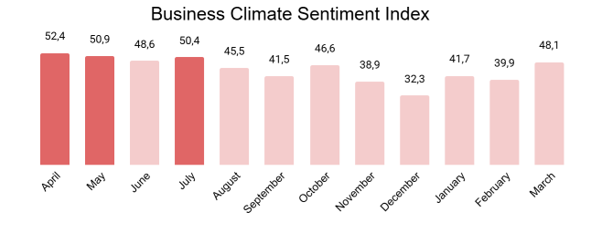

The Business Climate Sentiment Index jumped 8,2 points to 48,1

The share of positive assessments nearly doubled during the reporting period—from 7,6 p.p. to 14,4 p.p.

67,3% of survey participants held a neutral opinion about the state of the business climate in the country.

Social and Investment Activity Index in March 2025

As in the previous reporting period, more than two-thirds of surveyed enterprises were engaged in investment projects.

Among organizations investing in projects, 75,4% implemented their programs without any changes to schedules or budgets. The figure rose 9,3 percentage point, marking a significant change.

14,5% of enterprises fell behind on investment projects, while 2.9% completed them ahead of schedule., while 2,9% were ahead of schedule.

Additionally, 14,5% of companies had to reduce their investment volumes during the reporting period, while only 4,3% of enterprises managed to increase them.

88,5% of companies hired new employees. Only 2,9% of respondents reported layoffs in their organizations. Measures to reduce working hours for cost optimization were implemented by 6,7% of organizations.

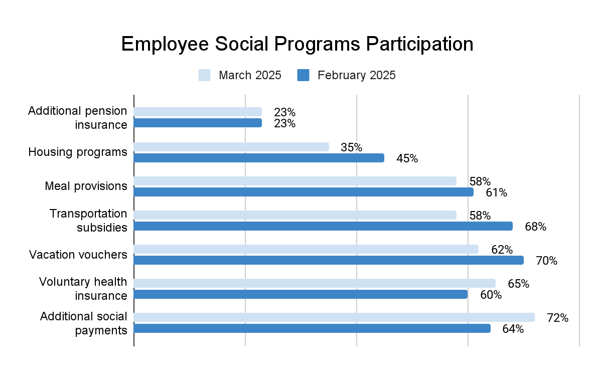

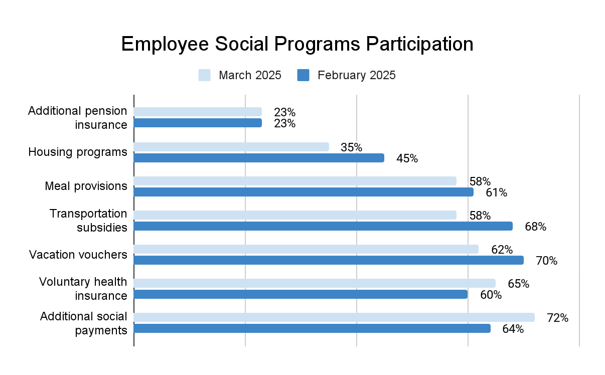

88,5% of companies ran employee social programs, with the share increasing by 5 p.p.

Social support for other categories of citizens was provided by 52,9% of companies, a decline of 8 p.p., returning to the level recorded in January's survey round.

*100% represents the total number of companies that reported implementing social programs for employees. Companies could select multiple responses, so the sum of shares does not equal 100%.

In 71% of companies, the budget for social programs remained unchanged.

26,9% of respondents reported increased expenditures, while only 2,2% of surveyed enterprises reduced their budgets.

Approximately 70% of companies took steps to ease labor market pressures. Half of the organizations sent employees for internships and/or invested in advanced training for staff. 28,8% of companies organized temporary employment.