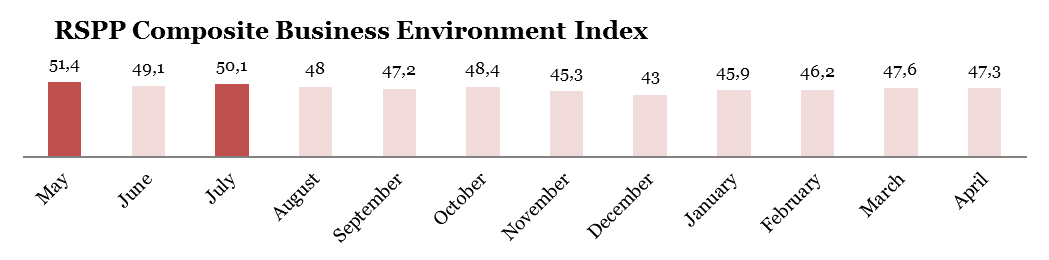

The Russian Union of Industrialists and Entrepreneurs conducted another round of surveys among industrialists and entrepreneurs in April 2025. The value of the Composite Index decreased slightly – by 0.3 points to 47.3 points.

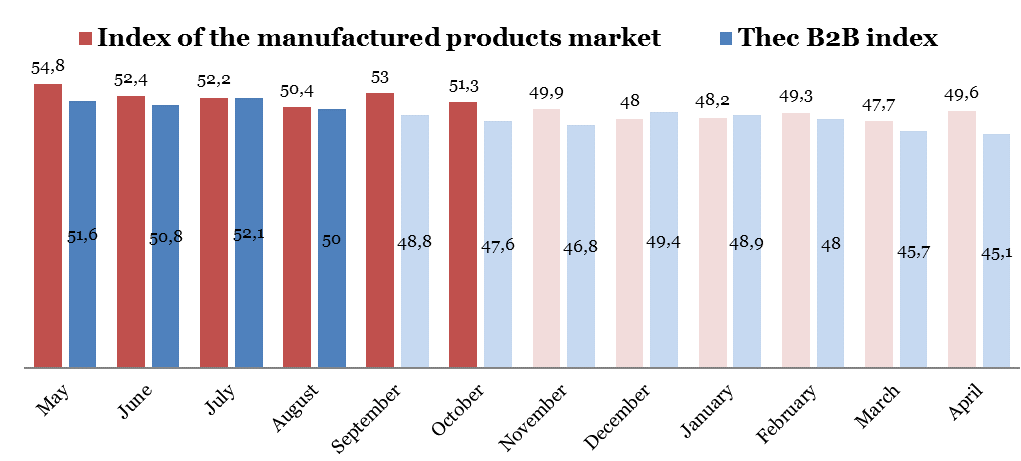

The index of the manufactured products market amounted to 49.6 points, its value increased by 1.9 points over the month.

The "purchase price" indicator dropped by 2.4 points on the scale to 18.8 points.

59.4% of respondents reported that purchase prices continued to rise during the reporting period. The rest of the survey participants chose the answer "the situation has not changed."

The value of the "selling prices" indicator is 62.3 points against the March value of 59.9 points. According to the survey results, 31.9% of companies have raised prices for their products or services. A month ago, less than a quarter of the respondents stated this.

Demand indicators – in the industry and for the products of the companies themselves – rose by 1.2 and 2.3 points on the scale, reaching 49.3 and 50.4 points, respectively.

Demand for products or services increased in 23.2% of companies. The respondents chose negative ratings a little less often – in 21.7% of cases. More than half of the participants (55.1% of enterprises) assessed the demand situation neutrally.

The value of the "level of competition" component of the Index immediately increased by 5.9 points, eventually reaching 67 points (and this is the maximum for the last seven years of the study).

The dynamics of the B2B Index is negative again, its value fell by 0.6 points to 45.1 points.

This is due to the deterioration of the situation with the fulfillment of obligations, both on the part of companies and on the part of counterparties. In the first case, the indicator was 44.2 points, in the second – 36.2 points. Both values decreased by more than 2 points.

73.9% of respondents noted that the situation with the fulfillment of obligations to counterparties remained the same. In 18.8% of companies, there were more outstanding obligations, and only in 7.3% of organizations, on the contrary, their number decreased.

The share of companies that found it more difficult to fulfill their obligations to counterparties than it was in March increased by 7 percentage points.

Almost 30% of the enterprises participating in the survey faced non-fulfillment of obligations on the part of counterparties during the reporting month. The share of such responses added 4 percentage points.

The number of new orders increased in a quarter of companies. 62.3% of respondents chose the option "the situation has not changed". A month ago, participants were less likely to choose a positive answer. Due to the redistribution of ratings, the indicator rose up the scale to 54 points.

The indicator "deadlines for completing current orders" amounted to 46 points (+0.3 points compared to the March value).

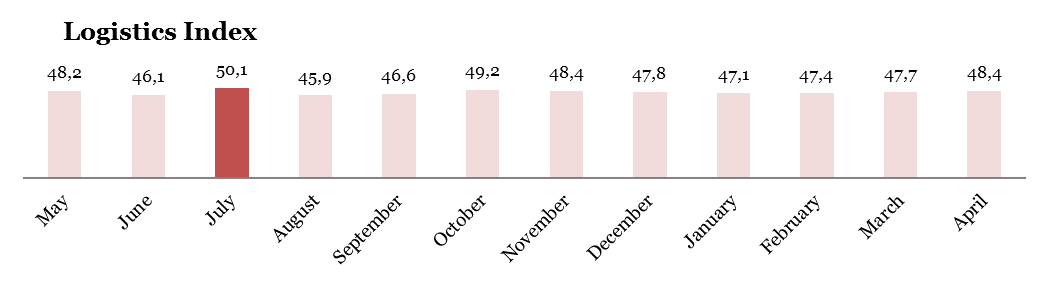

The value of the Logistics Index rose to 48.4 points, adding 0.7 points.

The average delivery time remained unchanged, according to the estimates of the majority of respondents – 82.6%. An increase in time spent on delivery was reported by 14.4% of companies. In only 2% of organizations, product delivery began to take less time. Compared to the data obtained in March, respondents were less likely to choose negative assessments. Accordingly, the value of the indicator increased by 2 points to 43.8 points.

The "inventory level" indicator maintains its position in the positive assessment zone, amounting to 56.2 points (+0.7 points).

At the same time, respondents rated the overall state of logistics slightly worse than in the previous reporting period, with the value of this component of the Index falling by 0.4 points to 45.3 points.

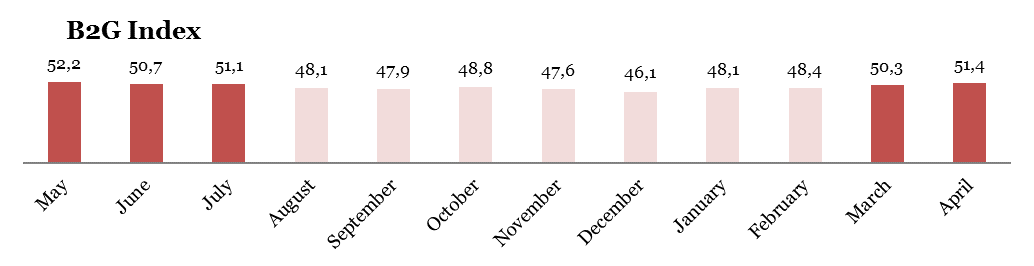

The B2G index has been in the positive assessment zone for the second month, its value has added another 1.1 points. As a result, it is equal to 51.4 points.

As in the previous month, this is due to the positive dynamics of indicators characterizing relations with financial institutions and foreign partners.

In the first case, the value of the indicator increased by 1.6 points. 85.5% of respondents settled on a neutral answer, "the nature of relations with banks and financial institutions has not changed." 8.7% of the participants saw an improvement in their relationship, while 5.8% saw a slight deterioration.

For the first time since November 2021, the indicator "relations with foreign partners" has risen on the scale to the boundary mark of 50 points. In the last reporting period, its value was 47.8 points.

88.4% of the respondents chose the neutral answer "the situation has not changed", while the rest of the companies were divided in their opinions – both positive and negative assessments of relations with foreign partners amounted to 5.8% each. A month ago, negative ratings prevailed over positive responses.

There have been no changes in the relationship between business and government, according to 89.9% of companies. 7.2% of the respondents stated an improvement in their relations. 2.9% of respondents indicated negative ratings, and their share increased by 1.9 percentage points.

Due to this redistribution of estimates, the indicator characterizing the dynamics of relations between business and government structures lost 0.5 points.

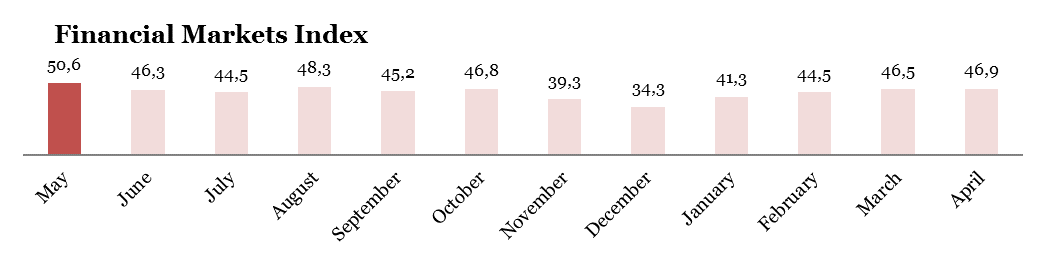

The value of the Financial Markets Index increased by 0.4 points to 46.9 points.

The financial situation has not changed in 69.6% of the surveyed companies. According to the estimates of a fifth of respondents, it has become worse. Accordingly, a tenth of the companies, on the contrary, managed to strengthen their financial position.

The share of negative ratings remained the same, but the share of companies reporting an improvement increased by 3 percentage points over the month.

Due to this, the indicator added 1 point and amounted to 43.8 points.

The estimates of the foreign exchange market also turned out to be shifted to the neutral and positive zones – the indicator reached the boundary mark of 50 points. The vast majority of respondents – 91.2% of respondents - stated that the situation in the foreign exchange market had not changed during the reporting period. An equal number of survey participants chose negative and positive ratings. Last month, the share of negative ratings was higher than the share of positive responses by 3 percentage points.

The value of the Stock market Index component was 46.7 points (-2.1 points from the value obtained in March).

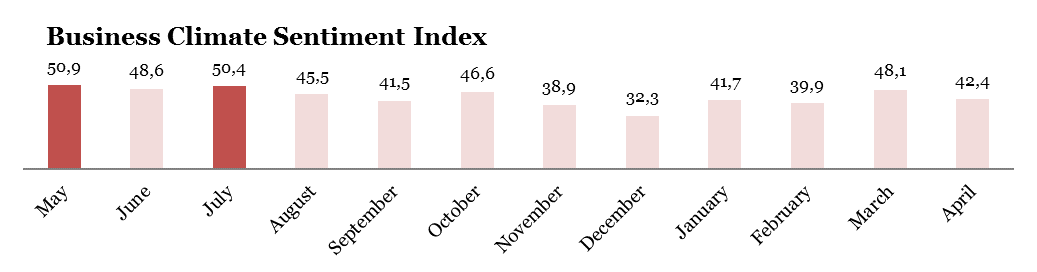

If in the last reporting period the Business Climate Index immediately rose by 8.2 points on the scale, then in April the pendulum swung in the opposite direction, and the Index value again decreased by 5.7 points to 42.4 points.

More than a quarter of the respondents are confident that the state of the business climate in the country has changed for the worse in a month. The share increased by 7.8 percentage points.

Social and Investment Activity Index in April 2025

Investment programs were implemented by 73.9% of companies in the reporting month.

79.7% of organizations employed employees. 2.9% of enterprises fired employees.

7.2% of companies used measures to reduce working hours to optimize costs.

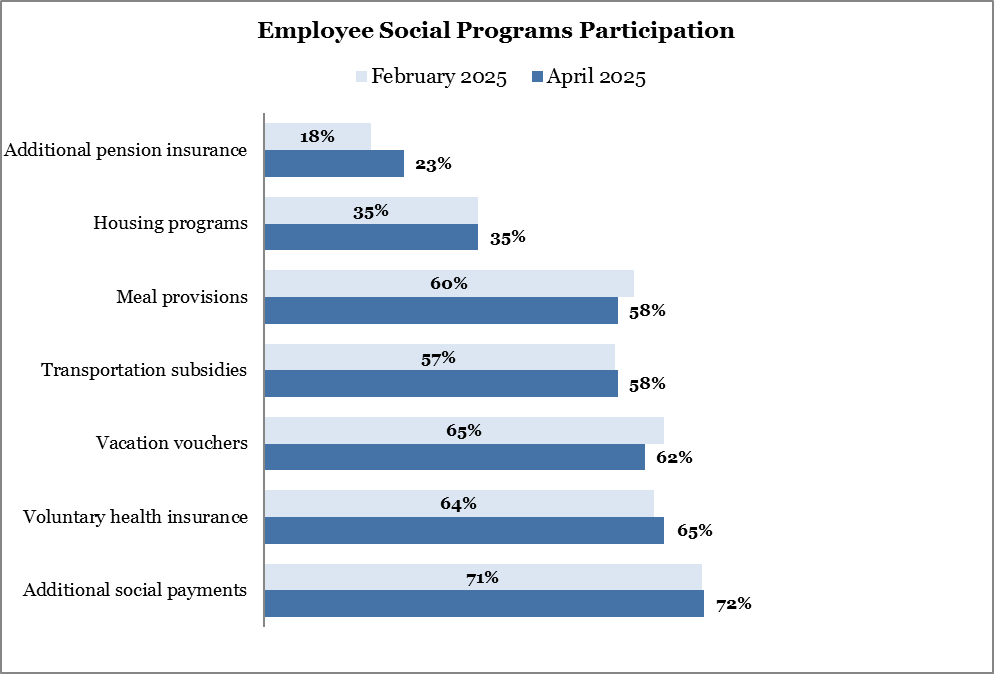

89.9% of organizations implemented social programs for employees, and 58% of companies implemented programs aimed at supporting other categories of citizens.

If we talk about social programs for employees, they included:

- payment of additional funds to employees that are not provided for by the Labor Code of the Russian Federation (the share of the option is 71.4%);

- payment of vouchers for sanatorium treatment and children's holidays (65.1%);

- voluntary health insurance (63.5%);

- providing employees with food (60.3%);

- payment for transportation or delivery to work (57.1%);

- housing programs, including mortgages (34.9%);

- additional pension insurance (17.5%).

Some participants added their own answers to the question about social programs: they conducted programs to support and develop young employees; implemented corporate sports development programs, including organizing sports and cultural events; paid employees for gyms and fitness centers; provided maternity and childhood support, including support for large families; provided compensation to employees to pay for non-governmental preschool institutions; helped veterans and pensioners of enterprises; compensated for medical treatment; They provided additional vacation days; provided support to their employees and mobilized employees; gave gifts to employees' children on holidays and organized children's parties.

*100% represents the total number of companies that reported implementing social programs for employees. Companies could select multiple responses, so the sum of shares does not equal 100%.