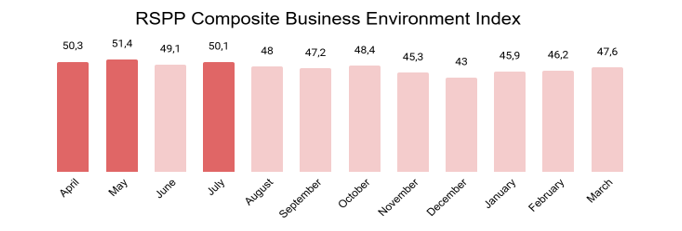

In December 2025, the Russian Union of Industrialists and Entrepreneurs (RSPP) recorded a marginal decline in its composite Business Environment Index, which fell by 0.5 points to 46.1 points. The survey of industrial and business leaders revealed a notable softening in core economic activity, driven primarily by a contraction in demand.

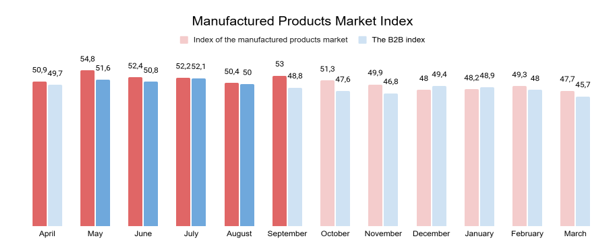

The most significant pressure came from the Product Market Index, which dropped 3.6 points to 43.8. Respondents reported a marked decrease in both sector-wide demand and demand for their own products and services. The share of companies reporting reduced demand rose by approximately 10 percentage points compared to November. Consequently, the "industry demand" indicator fell sharply to 39.1 points from 45.5, while "demand for a company's own products/services" plummeted to 40.0 points from 49.2.

Input cost pressures persisted, with the "purchase prices" indicator falling to 28.5 points (-2.1), as nearly half of surveyed firms noted an increase. In contrast, selling price momentum weakened: the "selling prices" indicator fell 2.7 points to the neutral threshold of 50 points, with 68.2% of firms reporting stable prices. The proportion of companies raising prices declined to 16.5% from 19.2% in November.

Operational indicators presented a mixed picture. The "level of competition" component rose 1.9 points to 61.2, returning to its October level. However, the B2B Index declined by 2.2 points to 46.5, and "new order volume" fell 2.5 points to 51.8, with a growing share of companies (21.2%, up from 14.9%) reporting a decrease. The indicator for "fulfillment of obligations by companies" dipped into negative territory at 47.1 points, with a 5%-point increase in firms reporting more unmet obligations.

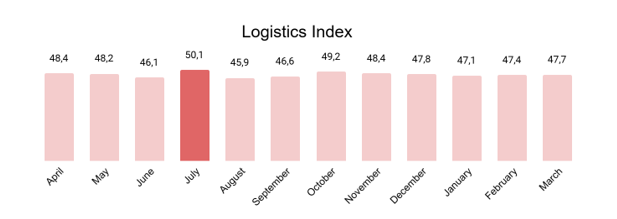

The logistics sector showed signs of stabilization. After two months of decline, the Logistics Index rose 2.9 points to 49.0. This was supported by a significant improvement in "inventory levels," which jumped 5.6 points into positive territory at 53.2. However, "average delivery time" remained a challenge, inching up 3 points to 48.5.

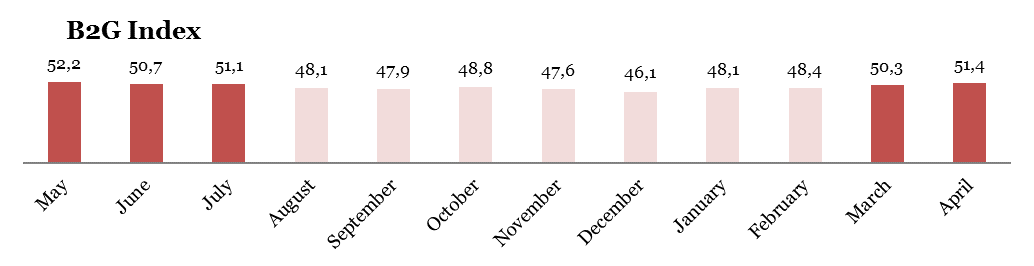

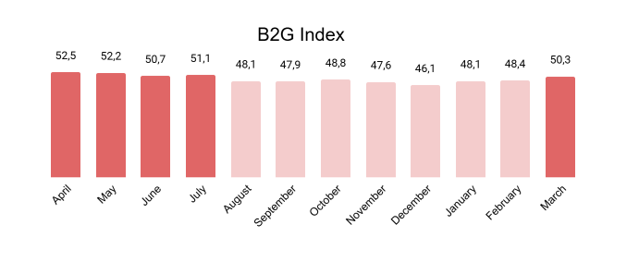

A notable bright spot emerged in external relations. For the first time in four years, the indicator for "relations with foreign partners" entered positive territory at 51.5 points, with 8.2% of companies noting an improvement. The B2G (business-to-government) Index also remained positive for the second consecutive month at 53.0 points, reflecting slightly more optimistic assessments of business-state relations.

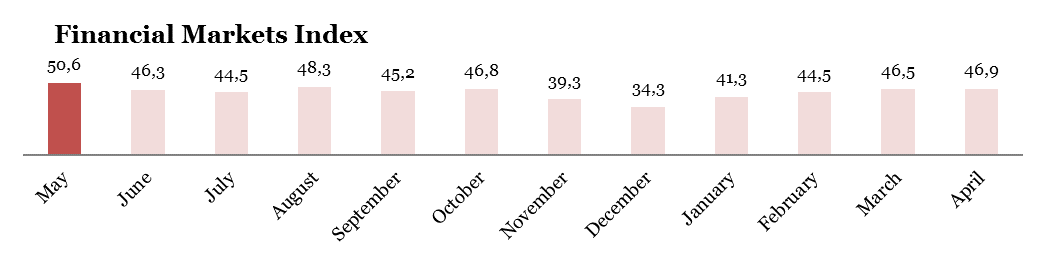

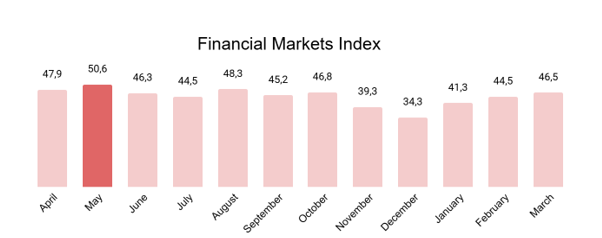

Financial market sentiment softened, with the corresponding index losing 1.1 points to settle at 45.4. The "financial position of companies" indicator declined to 41.8 points, as more firms (27.1%, up from 21.2%) reported a deterioration in their financial standing.

Social and Investment Activity, Stability Amid Challenges

On the investment front, 67.1% of companies maintained active investment programs, with two-thirds executing them without changes to schedule or budget. However, 14.5% were forced to reduce investment volumes, slightly outpacing the 12.5% that increased spending.

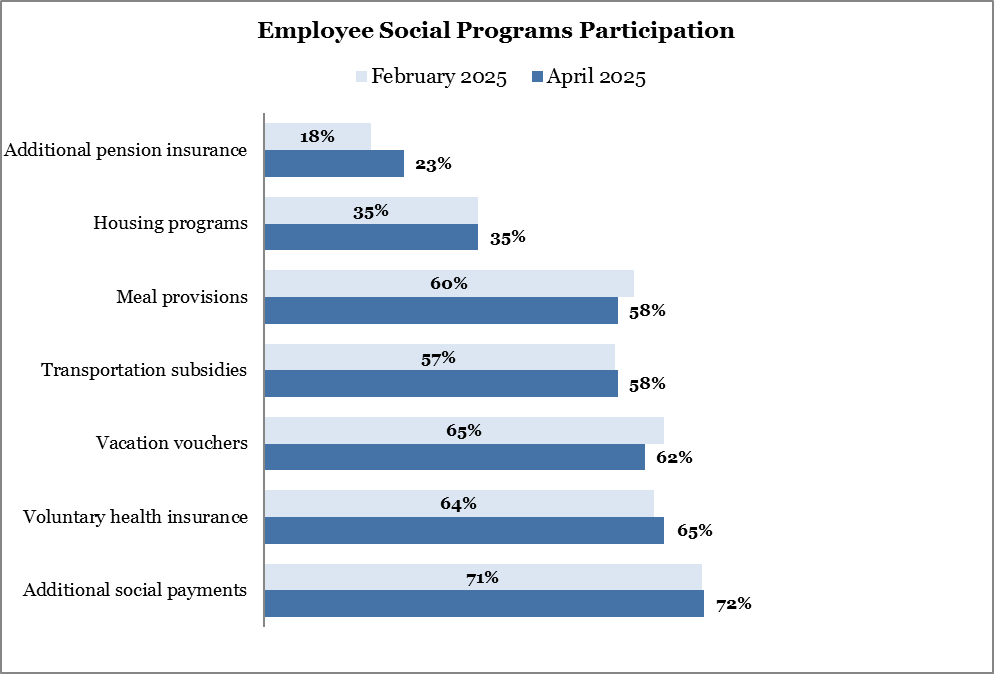

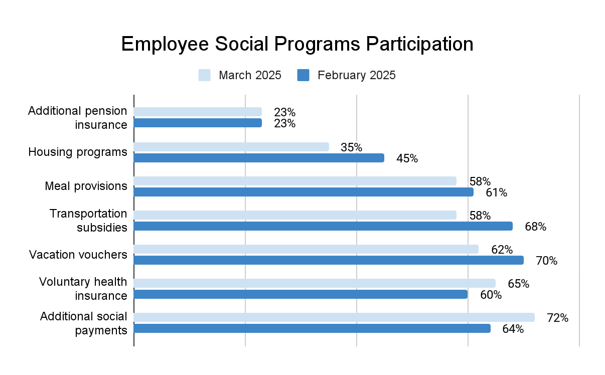

The labor market demonstrated resilience, with 77.6% of companies hiring new staff and only 9.4% reporting layoffs. A significant 89.4% of organizations maintained social programs for employees, the most common being subsidized resort/child recreation (71.1%), voluntary health insurance (64.5%), and extra-contractual payments to staff (59.2%). Budgets for these programs remained unchanged for 77.9% of firms.

Furthermore, 62.4% of companies participated in additional measures to ease labor market tensions, primarily through internships (49.4%) and advanced training programs (36.5%).

In summary, the December 2025 survey depicts a business environment dealing with weakening demand and financial pressures, offset by stable investment, a resilient labor market, and cautious optimism regarding logistics and certain external relations.

For more details, click

MOSCOW – Russia’s business environment showed tentative signs of stabilization in November 2025. According to the latest survey from the Russian Union of Industrialists and Entrepreneurs (RSPP), the key Composite Business Climate Index halted its decline, returning to its September level of 46.6 points. This apparent stabilization, however, conceals a more complex reality, where encouraging signals from core business operations are offset by enduring constraints in logistics and a cautious investment climate.

Improving Market Conditions and Pricing

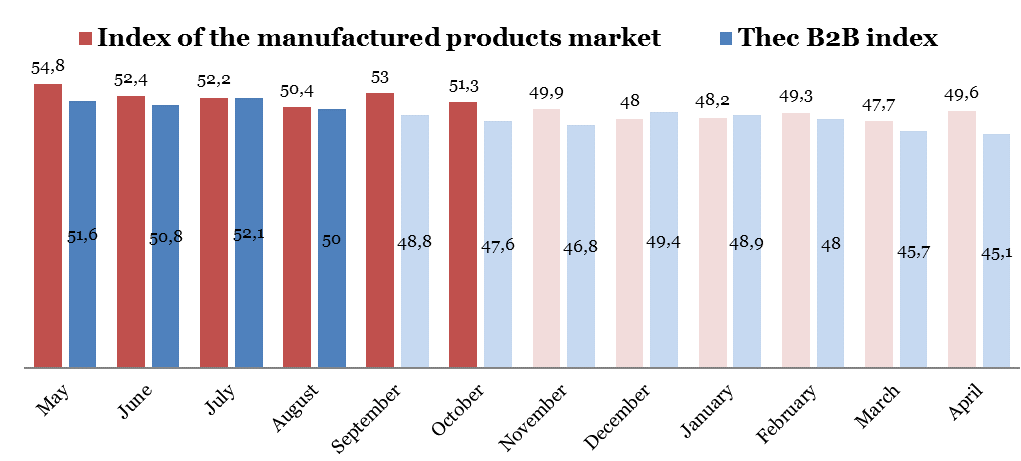

The performance of the product market index rose by 1.8 points to 47.4. This was underpinned by a significant rebound in the B2B Index, which jumped 4.4 points to 48.7 after recently hitting a three-year low. Both demand within industries and for companies' own products saw positive shifts, with the latter nearing the 50-point threshold that separates contraction from expansion.

Pricing dynamics also improved. While purchase prices increased, the number of respondents reporting price hikes actually fell by 6%. More significantly, the sales price index entered positive territory, climbing to 52.7 points, suggesting companies are finding slightly more room to pass on costs.

Strengthening Contracts and Orders

Business reliability saw a marked improvement. The index for companies fulfilling their obligations surged 5.6 points to 51.6, re-entering positive assessment territory. Reports of growing unmet obligations halved, and a similar positive trend was noted for counterparties' reliability. This renewed confidence was reflected in new orders. The new orders index broke a two-month negative streak, leaping 6 points to a positive 54.3, driven by a 7.5% increase in companies reporting more orders.

Logistics and Competition: Emerging Pressure Points

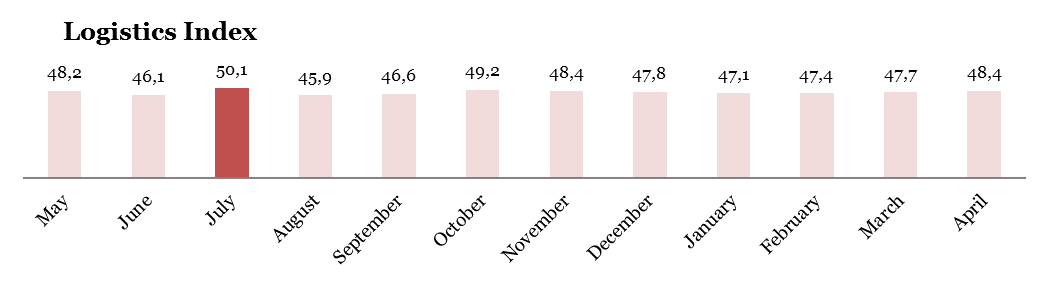

However, not all signals were positive. The Logistics Index continued its gradual decline to 46.1 points. For the first time in two years, the assessment of warehouse inventory levels fell into negative (47.6 points), with fewer companies reporting improvements. This was partly offset by a slight improvement in overall logistics sentiment and delivery times. Furthermore, the competitive landscape intensified, with the level of competition index falling 2.1 points to 59.3.

Financial Sector and External Relations

The financial markets index showed a solid recovery, gaining 4.1 points to 46.5. Assessments of companies' own financial positions improved noticeably; the share of firms reporting a deterioration fell from over a quarter to a fifth, pulling the index up to 43.1 points. The stock market index also saw a sharp rebound of 6.6 points, as the number of negative assessments plummeted.

While the overall appraisal of relations with foreign partners remains marginally in negative territory, it improved significantly as the proportion of negative assessments fell by half.

Social and Investment Activity: A Mixed Picture

The social and investment sphere presented a contrasting view. On one hand, the proportion of companies running investment programs fell by 5.3 percentage points to 57.4%. However, among those investing, three-quarters reported sticking to their original schedules and budgets, and far fewer companies were forced to cut investment volumes.

Hiring remained robust, with 77.7% of companies recruiting, returning to September's levels. Social programs for employees were widespread (85.1% of companies), with the most common forms being extra-contractual payments, sanatorium vouchers, and private health insurance. For most companies (80.5%), social spending budgets remained unchanged.

To summarize, the Russian business landscape in November 2025 was characterized by a tentative recovery, driven by improved demand and operational reliability. Nonetheless, this progress remains vulnerable to enduring headwinds, most notably in the logistics sector, a highly competitive market, and a discernible pullback in corporate investment.

For more details, click

The Russian business environment deteriorated to its lowest point this year, according to the latest Business Climate Index from the Russian Union of Industrialists and Entrepreneurs (RSPP). The composite index fell to 44.3 points in October, signaling growing pessimism among industrialists and entrepreneurs, primarily driven by a worsening crisis in payment discipline between companies.

The survey results paint a picture of an economy facing internal strain, even as some external pressures have stabilized. The dynamics of demand were mixed: while perceived demand across entire industries fell, a slightly larger share of companies (20.3%) reported a rise in demand for their own products compared to those who saw an increase in broader sectoral demand (16%).

Deepening Corporate Illiquidity

The most alarming data comes from the B2B Index, which plummeted to a three-year low of 44.3 points. This decline is directly attributed to a sharp deterioration in the fulfillment of contractual obligations. The indicator measuring companies' own default rate fell by 5.6 points, while the metric for counterparties' defaults dropped 3.7 points to a very low 34.7 points. Crucially, the balance of responses shifted negatively: in October, 10% of firms reported an increase in their own unmet obligations (double the 5% that saw a decrease), and a full third of respondents reported a rise in defaults by their partners.

Logistics and Financial Pressures Mount

After five months in positive territory, the Logistics Index fell back into negative assessment, dropping to 46.5 points. This was largely due to a significant drawdown in warehouse inventories and longer average delivery times, suggesting companies are de-stocking amid uncertainty.

The financial outlook for companies also darkened. The "financial position of companies" indicator fell to 39 points, with over a quarter of respondents reporting a worsening of their financial health. The state of the stock market was assessed at 41.3 points, with 16.1% of businesses noting a negative dynamic and not a single respondent reporting an improvement. The only faint positive note in the financial sector was a slight stabilization in the currency market, which most companies (90.7%) described as unchanged.

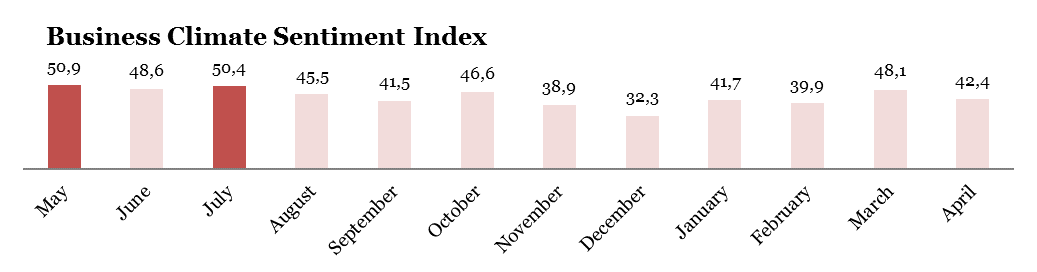

Reflecting this challenging environment, the Personal Assessment Index fell to 36.9 points. A significant 31.3% of business representatives believe the country's business climate has worsened, while only 7.6% hold a positive view.

Investment and Social Activity: A Glimmer of Resilience

Despite the gloomy business climate, the data on corporate activity reveals a degree of resilience. Two-thirds of organizations continued to implement investment projects, with the majority (67.9%) doing so without changes to their schedule or budget. However, one-fifth of companies were forced to cut investment volumes.

The labor market showed strength, with 87.3% of companies reporting new hiring, a significant 12.3% increase from the previous period. Layoffs were reported by only 6.8% of organizations.

Social support for employees remains widespread, with 85.6% of companies maintaining such programs. The most common benefits are voluntary health insurance (66%), additional payments beyond legal requirements (63.1%), and subsidized vacation packages and children's camps (59.2%). For most companies (76.4%), spending on these social programs remained unchanged, though 14.5% managed to increase their budgets.

In summary, the October 2025 survey depicts a Russian business sector grappling with a severe internal liquidity crunch and logistical setbacks. While investment and employment have so far held relatively steady, the collapse in payment discipline and worsening financial assessments point to underlying vulnerabilities that threaten the economy's stability as the year draws to a close.

For more details, click

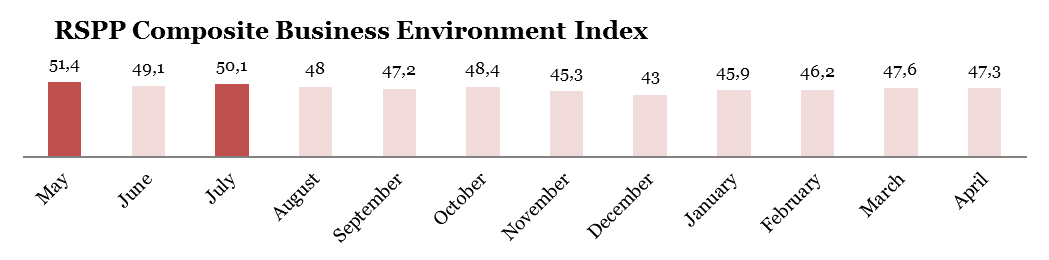

In September 2025, the Russian Union of Industrialists and Entrepreneurs (RSPP) released findings from its latest survey of industrialists and entrepreneurs, offering insights into the state of Russia's business landscape. The Composite Business Environment Index held steady at 46.6 points, a marginal increase from 46.5 points in August, signaling a stable yet cautious economic climate.

The Market of Manufactured Products Index saw a modest rise of 1.9 points to 45.7, driven by positive demand trends. Industry-wide demand improved notably, climbing 4.8 points to 46.2, with 21.4% of respondents reporting growth compared to just 14.8% in August. However, demand for individual company products grew more slowly, up 1.8 points to 44.2, with only 18.8% of businesses noting an increase. Procurement prices edged up slightly to 24.8 points, while sales prices dipped by 1.4 points, reflecting fewer companies raising prices. Competition intensified, with the level of competition indicator rising 4.4 points to 63.3, as a quarter of respondents observed heightened competitor activity.

The B2B Index slipped slightly to 46.4 points from 46.9 in August. New orders weakened, falling to 45.5 points, with 23.2% of companies reporting a decline compared to 17.7% the previous month. On a positive note, production timelines improved, reaching a neutral 50 points, up 2.8 points. The fulfillment of obligations to counterparties remained solid at 51.6 points, though a persistent 13.2-point gap highlighted challenges in counterparty reliability, with nearly 30% of firms noting increased unfulfilled obligations.

Logistics showed resilience, with the Logistics Index holding in positive territory at 50.7 points for the fifth consecutive month. Warehouse stock levels stood at 57.4 points, with one-fifth of companies reporting increases. Delivery times improved marginally to 47.1 points, with 5% of firms reducing delivery times compared to 2.8% in August. Overall, the logistics sector's outlook brightened, with its assessment rising by 1.9 points.

The B2G Index, reflecting business-government relations, remained stable at 51.6 points. Approximately 85% of respondents reported no significant changes in ties with financial institutions or government bodies, though nearly 10% noted slight improvements. Relations with foreign partners saw a more positive shift, with the indicator rising from 47.9 to 49.1 points.

The Financial Markets Index stayed nearly flat at 44.5 points. However, the financial position of companies deteriorated slightly to 41.7 points, with 26.8% of firms reporting a worsening situation, up from 20% in August. Stock and currency market indicators showed minimal change, rising to 46 and 45.8 points, respectively, with over 85% of respondents viewing these markets as stable.

Personal assessments of the business climate took a hit, dropping 2.6 points to 40.5, with 30.4% of respondents noting a decline, a 6% increase in negative sentiment. Investment activity remained consistent, with 63.4% of companies engaged in projects, two-thirds of which proceeded on schedule and within budget. However, a quarter of firms lagged behind, and one-fifth reduced investment budgets, though 13.9% increased spending.

Hiring trends softened, with 75% of companies recruiting, down from 80% in August and 85% earlier in the year. Layoffs rose, affecting 10% of firms, up 7% from prior months. Cost-cutting measures, such as reduced working hours, were implemented by 10.8% of organizations. Social programs remained robust, with 80.4% of companies supporting employees through benefits like spa vouchers (69.2%), additional payments (67%), and voluntary health insurance (62.6%). Nearly half of the firms also supported broader community initiatives.

The September 2025 survey paints a picture of a business environment marked by cautious optimism, with gains in logistics and competition offset by softening demand, financial pressures, and declining confidence.

As companies navigate these dynamics, the focus on investment and social programs underscores a commitment to resilience amid uncertainty.

For more details, click

In August 2025, Russia's business environment exhibited signs of cautious optimism, with the overall Composite Index edging up by 0.7 points to 46.5, according to a survey by the Russian Union of Industrialists and Entrepreneurs (RSPP). Despite this slight improvement, the index remains below the 50-point threshold, indicating that a negative assessment continues to prevail among businessmen.

The landscape of demand presented a contradictory picture. While perceived demand within industrial sectors saw an improvement, the demand for companies' own products and services fell significantly. This decline is attributed to a notable increase in the number of respondents reporting a drop in orders for their goods. The pressure on businesses continued from the cost side, with a majority of 51.8% reporting rising input prices, causing the corresponding index to fall. In contrast, selling prices remained largely stable, hovering in slightly positive territory.

Operational indicators were mixed. In a positive development, the volume of new orders received by companies crossed into positive territory for the first time, marking a significant monthly improvement. However, companies reported a slight easing in competitive pressures and a minor lengthening in order fulfillment times. The logistics sector sent conflicting signals; while warehouse inventory levels rose substantially and the overall logistics index was stable, qualitative assessments of the logistical situation itself worsened, with more businesses reporting deterioration than improvement.

A notable bright spot was the relationship between businesses and the state. The B2G Index returned to positive ground, driven by a slight preponderance of positive over negative responses regarding interactions with both financial institutions and government bodies. Financially, companies reported a modest improvement in their own financial positions, though perceptions of the stock and currency markets remained neutral to negative. This contributed to a significant jump in personal optimism, with the index of personal assessments rising sharply as negative views on the country's business climate contracted.

Beyond immediate business concerns, the survey revealed robust investment and social activity. Nearly two-thirds of respondents were actively pursuing investment projects, and crucially, a overwhelming 82% of them were doing so without any delays or budget overruns—a significant increase from the previous month.

The labor market appears stable, with an overwhelming majority of companies hiring and only a small fraction reporting layoffs. Social programs for employees are widespread, with 86.1% of companies offering benefits such as extra payments, health insurance, and vacation vouchers. Most companies held their social spending steady, and a strong majority also engaged in additional measures to support the labor market, primarily through employee internships and advanced training programs.

In summary, the August 2025 data paints a picture of an economy finding a fragile equilibrium. Businesses are navigating persistent cost pressures and uneven demand but are responding with stable investment, hiring, and social support, all while expressing a slightly more optimistic outlook for the future.

For more details, click

The latest survey by the Russian Union of Industrialists and Entrepreneurs (RSPP) reveals a slight deterioration in business sentiment during July 2025, with the composite Business Environment Index declining by 1.4 points to 45.8 points. This downward trend reflects growing caution among industrialists and entrepreneurs, driven primarily by weakening demand and ongoing price pressures. While selling prices showed modest improvement, rising to 51.1 points and re-entering positive territory, purchase prices remained depressed at 28.5 points despite nearly half of surveyed firms reporting continued cost increases. The B2B sector remained stagnant, with new orders dropping further to 46.8 points, indicating persistent challenges in securing business.

Logistics performance presented a mixed picture. Although the Logistics Index maintained its positive trend for the third consecutive month at 50.4 points, delivery times worsened significantly, with the indicator falling to 44.1 points. Nearly 14% of companies reported longer shipping delays, up sharply from 6.8% in June. Meanwhile, government-business relations showed volatility, with the B2G Index slipping to 49.2 points, just below the neutral threshold. Financial market sentiment also softened, with the Financial Markets Index dropping to 44.1 points as companies expressed greater concern about their financial positions.

On the investment front, two-thirds of surveyed enterprises maintained their capital expenditure programs, with most reporting adherence to original schedules and budgets. However, nearly 20% were forced to scale back investments, outweighing the 4.5% that increased spending. The labor market demonstrated resilience, with 85% of firms continuing to hire, though a small but notable 7.5% implemented layoffs or reduced working hours. Social programs remained widespread, with 84% of companies offering employee benefits ranging from healthcare support to housing assistance. The vast majority of companies kept social budgets unchanged, signaling stability in corporate welfare commitments despite broader economic headwinds.

The business climate faces challenges from softening demand, supply chain disruptions, and strained foreign partnerships. However, the sustained investment activity and robust employment figures suggest underlying resilience in Russia's industrial sector. The coming months will prove critical in determining whether these stabilizing factors can offset the prevailing negative trends in business sentiment.

For more details, click

In June 2025, the Russian Union of Industrialists and Entrepreneurs (RSPP) released its latest survey on the country’s business climate, revealing a mixed yet cautiously optimistic outlook. The Composite Business Environment Index rebounded to 47.2 points, matching its April level after a 1.8-point monthly increase. While certain sectors demonstrated resilience, others faced persistent challenges, reflecting the complexities of the current economic landscape.

The product market index declined to 44.7 points, marking a 1.1-point drop from the previous month. This downturn was primarily driven by two key factors: a historic low in sales prices (49.3 points, the weakest since July 2020) and a notable decrease in perceived competition levels (61.5 points, down by 6.9 points). However, demand conditions showed modest improvement, with both industry-wide and company-specific demand indicators rising by 2 points. Additionally, companies reported fewer concerns over procurement costs, as the share of negative responses fell by 3.5 percentage points, pushing the corresponding index up to 29.5 points.

The logistics sector remained in positive territory, with the overall index holding steady at 51.4 points. Despite this stability, underlying metrics revealed some strain: average delivery times and inventory levels both dropped by over 2 points, settling at 46.6 and 58.6 points, respectively. Encouragingly, broader perceptions of logistics conditions improved, with the sector sentiment index climbing 3.1 points to 49 points. This shift was attributed to a growing share of respondents reporting logistical improvements—a sign that supply chain bottlenecks may be easing.

The B2B sector saw a slight uptick, with its index rising to 46.1 points (+0.5). However, a concerning development emerged in new orders, which fell into negative territory for the first time in three years (49.3 points, down 2.6 points). This decline coincided with a 5-percentage-point reduction in companies reporting increased order volumes. In contrast, the B2G (business-to-government) index staged a strong recovery, jumping 4.8 points to 51.8. Notably, not a single respondent described government relations as deteriorating—a stark improvement from May’s results.

Financial pressures on businesses appeared to ease slightly, with the financial position index climbing to 44.2 points (up from 41.7 in May). The share of firms reporting worsening conditions dropped from 25% to 20.5%, signaling tentative stabilization. Meanwhile, investment activity remained steady, with over 63% of companies continuing their programs—71.2% of which adhered to original schedules and budgets. Nevertheless, one-fifth of firms reduced investments, underscoring lingering caution.

Employment trends remained robust, with 83.6% of surveyed organizations actively hiring and none reporting layoffs. Companies also maintained strong social commitments: 93.2% ran employee support programs (including bonuses, healthcare, and housing aid), while 76.7% participated in labor market initiatives like retraining and temporary employment schemes. These efforts reflect a corporate emphasis on workforce stability amid economic fluctuations.

For more details, click here

In May 2025, the RSPP conducted another round of survey among industrialists and entrepreneurs, revealing a composite index of 45.4 points, 1.9 points less than the value obtained in the last reporting period. The negative dynamics of the RSPP Index are associated with a sharp decline in demand, deterioration in the B2G sector, and fluctuations in the currency market.

The index of the market of manufactured products dropped by 3.8 points on the scale, with respondents expressing significantly worsening demand than a month ago. The B2B Index rose 0.5 points to 45.6 points, while the Logistics Index moved into the positive assessment zone, gaining 51.8 points (+3.4 points).

The B2G index dropped to 47 points in the reporting period, with all indicators showing a decline, but the dynamics of the index characterizing the relations between Russian business and foreign partners look the worst. The Financial Markets Index fell by 2.8 points to 44.1 points, with a quarter of respondents stating that their companies' financial situation has deteriorated.

In terms of social and investment activity, more than two-thirds of enterprises participated in the survey in May 2025. Investment programs were implemented by more than two-thirds of the enterprises, with 63.6% of companies implementing projects without any changes in the schedule or budget. However, 18.2% of companies reported falling behind schedule, while 4.5% were ahead of schedule.

86.8% of organizations hired employees, and 5.5% used measures to reduce working hours to optimize costs. Social programs for employees were in place in 84.6% of organizations, and programs aimed at supporting other categories of citizens in 59.3% of companies.

Three quarters of organizations kept the budget for social programs unchanged, while 16.7% reported an increase in expenditures and 7.7% of surveyed enterprises reduced the budget. 75.8% of companies participated in the implementation of additional measures to reduce tension in the labor market, with more than half sending employees for internships and 48.4% engaged in advanced training.

For more details, click here

The Russian Union of Industrialists and Entrepreneurs conducted another round of surveys among industrialists and entrepreneurs in April 2025. The value of the Composite Index decreased slightly – by 0.3 points to 47.3 points.

The index of the manufactured products market amounted to 49.6 points, its value increased by 1.9 points over the month.

The "purchase price" indicator dropped by 2.4 points on the scale to 18.8 points.

59.4% of respondents reported that purchase prices continued to rise during the reporting period. The rest of the survey participants chose the answer "the situation has not changed."

The value of the "selling prices" indicator is 62.3 points against the March value of 59.9 points. According to the survey results, 31.9% of companies have raised prices for their products or services. A month ago, less than a quarter of the respondents stated this.

Demand indicators – in the industry and for the products of the companies themselves – rose by 1.2 and 2.3 points on the scale, reaching 49.3 and 50.4 points, respectively.

Demand for products or services increased in 23.2% of companies. The respondents chose negative ratings a little less often – in 21.7% of cases. More than half of the participants (55.1% of enterprises) assessed the demand situation neutrally.

The value of the "level of competition" component of the Index immediately increased by 5.9 points, eventually reaching 67 points (and this is the maximum for the last seven years of the study).

The dynamics of the B2B Index is negative again, its value fell by 0.6 points to 45.1 points.

This is due to the deterioration of the situation with the fulfillment of obligations, both on the part of companies and on the part of counterparties. In the first case, the indicator was 44.2 points, in the second – 36.2 points. Both values decreased by more than 2 points.

73.9% of respondents noted that the situation with the fulfillment of obligations to counterparties remained the same. In 18.8% of companies, there were more outstanding obligations, and only in 7.3% of organizations, on the contrary, their number decreased.

The share of companies that found it more difficult to fulfill their obligations to counterparties than it was in March increased by 7 percentage points.

Almost 30% of the enterprises participating in the survey faced non-fulfillment of obligations on the part of counterparties during the reporting month. The share of such responses added 4 percentage points.

The number of new orders increased in a quarter of companies. 62.3% of respondents chose the option "the situation has not changed". A month ago, participants were less likely to choose a positive answer. Due to the redistribution of ratings, the indicator rose up the scale to 54 points.

The indicator "deadlines for completing current orders" amounted to 46 points (+0.3 points compared to the March value).

The value of the Logistics Index rose to 48.4 points, adding 0.7 points.

The average delivery time remained unchanged, according to the estimates of the majority of respondents – 82.6%. An increase in time spent on delivery was reported by 14.4% of companies. In only 2% of organizations, product delivery began to take less time. Compared to the data obtained in March, respondents were less likely to choose negative assessments. Accordingly, the value of the indicator increased by 2 points to 43.8 points.

The "inventory level" indicator maintains its position in the positive assessment zone, amounting to 56.2 points (+0.7 points).

At the same time, respondents rated the overall state of logistics slightly worse than in the previous reporting period, with the value of this component of the Index falling by 0.4 points to 45.3 points.

The B2G index has been in the positive assessment zone for the second month, its value has added another 1.1 points. As a result, it is equal to 51.4 points.

As in the previous month, this is due to the positive dynamics of indicators characterizing relations with financial institutions and foreign partners.

In the first case, the value of the indicator increased by 1.6 points. 85.5% of respondents settled on a neutral answer, "the nature of relations with banks and financial institutions has not changed." 8.7% of the participants saw an improvement in their relationship, while 5.8% saw a slight deterioration.

For the first time since November 2021, the indicator "relations with foreign partners" has risen on the scale to the boundary mark of 50 points. In the last reporting period, its value was 47.8 points.

88.4% of the respondents chose the neutral answer "the situation has not changed", while the rest of the companies were divided in their opinions – both positive and negative assessments of relations with foreign partners amounted to 5.8% each. A month ago, negative ratings prevailed over positive responses.

There have been no changes in the relationship between business and government, according to 89.9% of companies. 7.2% of the respondents stated an improvement in their relations. 2.9% of respondents indicated negative ratings, and their share increased by 1.9 percentage points.

Due to this redistribution of estimates, the indicator characterizing the dynamics of relations between business and government structures lost 0.5 points.

The value of the Financial Markets Index increased by 0.4 points to 46.9 points.

The financial situation has not changed in 69.6% of the surveyed companies. According to the estimates of a fifth of respondents, it has become worse. Accordingly, a tenth of the companies, on the contrary, managed to strengthen their financial position.

The share of negative ratings remained the same, but the share of companies reporting an improvement increased by 3 percentage points over the month.

Due to this, the indicator added 1 point and amounted to 43.8 points.

The estimates of the foreign exchange market also turned out to be shifted to the neutral and positive zones – the indicator reached the boundary mark of 50 points. The vast majority of respondents – 91.2% of respondents - stated that the situation in the foreign exchange market had not changed during the reporting period. An equal number of survey participants chose negative and positive ratings. Last month, the share of negative ratings was higher than the share of positive responses by 3 percentage points.

The value of the Stock market Index component was 46.7 points (-2.1 points from the value obtained in March).

If in the last reporting period the Business Climate Index immediately rose by 8.2 points on the scale, then in April the pendulum swung in the opposite direction, and the Index value again decreased by 5.7 points to 42.4 points.

More than a quarter of the respondents are confident that the state of the business climate in the country has changed for the worse in a month. The share increased by 7.8 percentage points.

Social and Investment Activity Index in April 2025

Investment programs were implemented by 73.9% of companies in the reporting month.

79.7% of organizations employed employees. 2.9% of enterprises fired employees.

7.2% of companies used measures to reduce working hours to optimize costs.

89.9% of organizations implemented social programs for employees, and 58% of companies implemented programs aimed at supporting other categories of citizens.

If we talk about social programs for employees, they included:

- payment of additional funds to employees that are not provided for by the Labor Code of the Russian Federation (the share of the option is 71.4%);

- payment of vouchers for sanatorium treatment and children's holidays (65.1%);

- voluntary health insurance (63.5%);

- providing employees with food (60.3%);

- payment for transportation or delivery to work (57.1%);

- housing programs, including mortgages (34.9%);

- additional pension insurance (17.5%).

Some participants added their own answers to the question about social programs: they conducted programs to support and develop young employees; implemented corporate sports development programs, including organizing sports and cultural events; paid employees for gyms and fitness centers; provided maternity and childhood support, including support for large families; provided compensation to employees to pay for non-governmental preschool institutions; helped veterans and pensioners of enterprises; compensated for medical treatment; They provided additional vacation days; provided support to their employees and mobilized employees; gave gifts to employees' children on holidays and organized children's parties.

*100% represents the total number of companies that reported implementing social programs for employees. Companies could select multiple responses, so the sum of shares does not equal 100%.

In 77.3% of companies, the budget for social programs has not changed.

15.2% of respondents reported an increase in expenses, and 7.5% of enterprises surveyed had their budgets cut.

The Russian Union of Industrialists and Entrepreneurs (RSPP) conducted another round of surveys among industrialists and entrepreneurs in March 2025. The composite Index rose to 47,6 points, up 1,4 points from the previous month.

The Index for the market of manufactured products fell 1,6 points to 47,7. In particular, indicators for demand in the industry and for companies' own products/services, which had returned to the positive assessment zone last month, failed to sustain their position—their values equalized at 48,1 points. Accordingly, the assessment of demand in the industry decreased by 2,4 points, while the assessment of demand for companies' products or services dropped by 4,1 points.

The B2B Index showed negative dynamics, decreasing by 2,3 points to 45,7 points.

New orders showed little change: 65,4% of companies gave neutral responses, one-fifth of surveyed enterprises reported an increase in new orders, and 14,4% of companies saw a decline.

Companies faced greater difficulty in meeting their obligations to counterparties, compared to the previous month: this component of the Index stood at 46,4 points, down from February's 51,1 points. The indicator for "fulfillment of obligations by counterparties" also shifted negatively, dropping by 2,5 points to 38,5 points.

The Logistics Index reached 47,7 points, with a marginal monthly increase of 0,3 points.

Warehouse inventory levels held steady at 72,1% of organizations; one-fifth of enterprises reported an increase, while 8,7% saw a decrease.

The "average delivery time" indicator stood at 41,8 points (+0,5 points). 80,8% of respondents reported no change in delivery times for their companies. For 17,3% of organizations, delivery took longer than in the previous reporting period. Only 1,9% of enterprises managed to deliver products faster than a month ago.

The B2G Index moved into the positive assessment zone with a value of 50,3 points, rising by 1,9 points on the scale.

This growth reflected improvements in two key indicators: the dynamics of business relationships with financial institutions and foreign partners.

The "business-government relations" indicator, in turn, maintained its value at 53,4 points.

The Financial Markets Index stood at 46,5 points, up by 2 points compared to February's results.

The positive dynamics of the Index were attributed to growth in the indicators for "state of stock and currency markets." The former rose by 2,6 points to 48,8 points, while the latter increased by 3,2 points to 47,8 points.

The "financial position of companies" indicator remained unchanged at 42,8 points.

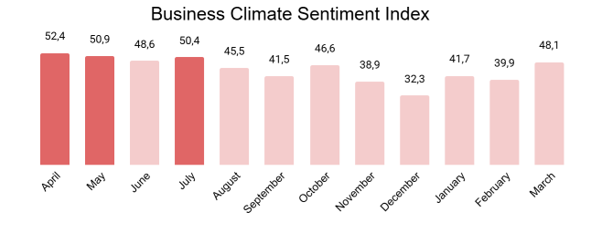

The Business Climate Sentiment Index jumped 8,2 points to 48,1

The share of positive assessments nearly doubled during the reporting period—from 7,6 p.p. to 14,4 p.p.

67,3% of survey participants held a neutral opinion about the state of the business climate in the country.

Social and Investment Activity Index in March 2025

As in the previous reporting period, more than two-thirds of surveyed enterprises were engaged in investment projects.

Among organizations investing in projects, 75,4% implemented their programs without any changes to schedules or budgets. The figure rose 9,3 percentage point, marking a significant change.

14,5% of enterprises fell behind on investment projects, while 2.9% completed them ahead of schedule., while 2,9% were ahead of schedule.

Additionally, 14,5% of companies had to reduce their investment volumes during the reporting period, while only 4,3% of enterprises managed to increase them.

88,5% of companies hired new employees. Only 2,9% of respondents reported layoffs in their organizations. Measures to reduce working hours for cost optimization were implemented by 6,7% of organizations.

88,5% of companies ran employee social programs, with the share increasing by 5 p.p.

Social support for other categories of citizens was provided by 52,9% of companies, a decline of 8 p.p., returning to the level recorded in January's survey round.

*100% represents the total number of companies that reported implementing social programs for employees. Companies could select multiple responses, so the sum of shares does not equal 100%.

In 71% of companies, the budget for social programs remained unchanged.

26,9% of respondents reported increased expenditures, while only 2,2% of surveyed enterprises reduced their budgets.

Approximately 70% of companies took steps to ease labor market pressures. Half of the organizations sent employees for internships and/or invested in advanced training for staff. 28,8% of companies organized temporary employment.

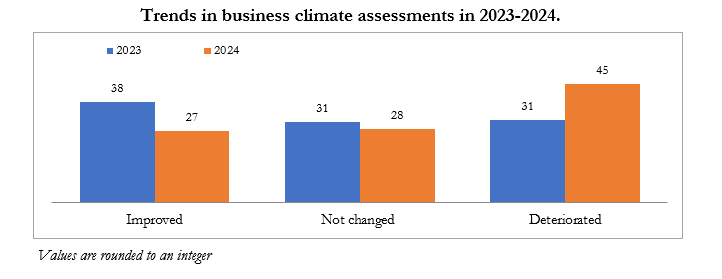

According to 45% of respondents, the business climate deteriorated in 2024. About 28% of the respondents believe that the situation remained unchanged while a similar proportion chose the response «the state of business climate has improved». Over the previous year the share of negative ratings has increased significantly – by 14 percentage points. At the same time companies have become less likely to provide positive responses.

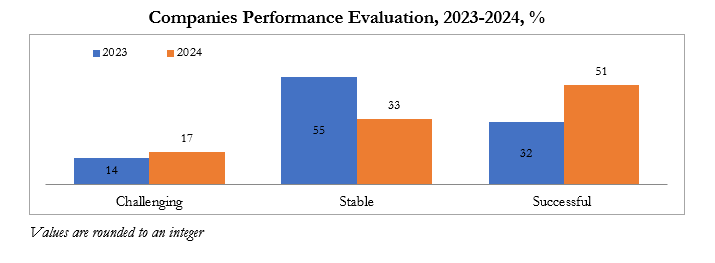

In 2024 companies’ performance was successful, according to 50,5% of respondents. A third selected «stable development» and 16,5% chose «challenging». Compared to 2023, respondents significantly more frequently selected positive evaluations, alongside a decline in the «stable» response category.

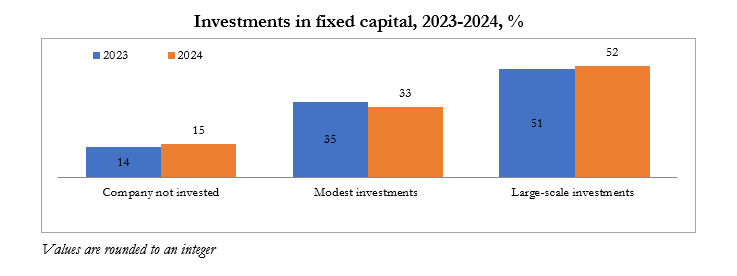

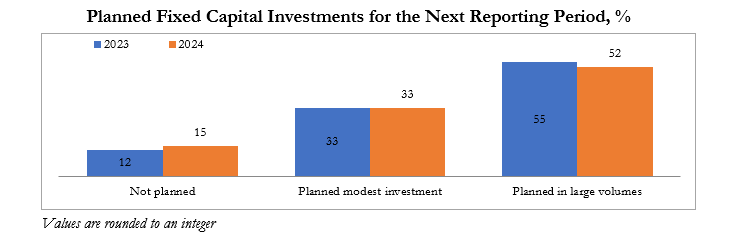

Russian companies maintained investment performance levels comparable to 2023. During the reporting period a majority of surveyed enterprises (51,9%) pursued large-scale investment projects. The volume of investments of a third of organizations was not so significant. These findings align with official statistics: fixed capital investments grew by 8.6% year-over-year in January-September 2024. However, about 15% of respondents indicated their companies did not implement investment programs in 2024.

In general, most companies anticipate maintaining their 2023-2024 investments levels in 2025. 85,4% of firms have planned investment programs. Over 50% of surveyed enterprises intend to allocate substantial investment funds. The investment budget of a third of the organizations will not be so significant. About 15% of companies expect no investment activity in 2025.

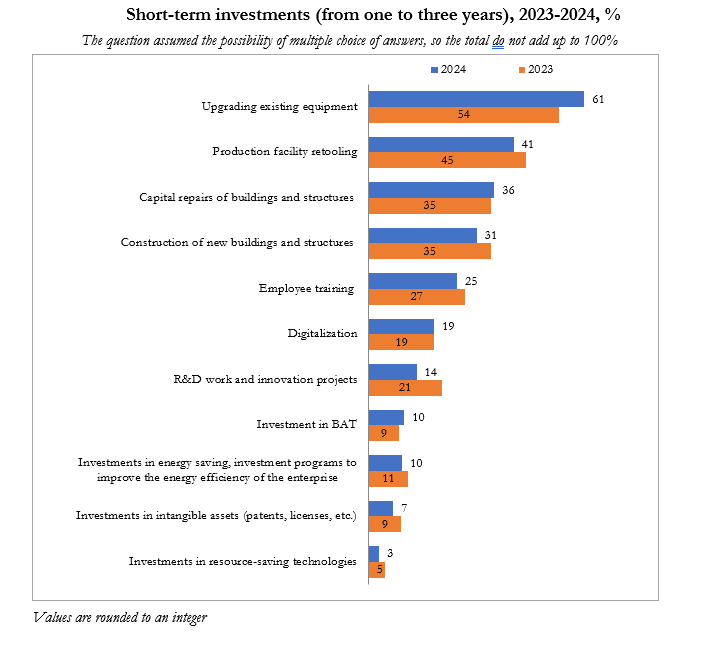

In the short-term, almost two third of the surveyed enterprises plan to invest in upgrading existing equipment. 41,2% of companies plan production facility retooling.

35,7% have allocated budgets for capital repairs of buildings and structures within a period of one to three years. The plans of 30.7% of companies involve the construction of new buildings and structures.

A quarter of companies want to invest in employee training and about under a fifth of the surveyed organizations (18,6%) intend to direct funds to digitalization projects.

13,6% are pursuing R&D work and innovation projects.

About a tenth of respondents are investing in the introduction of the best available technologies; in energy conservation, in programs to improve the energy efficiency of the enterprise; in intangible assets (patents, licenses, etc.).

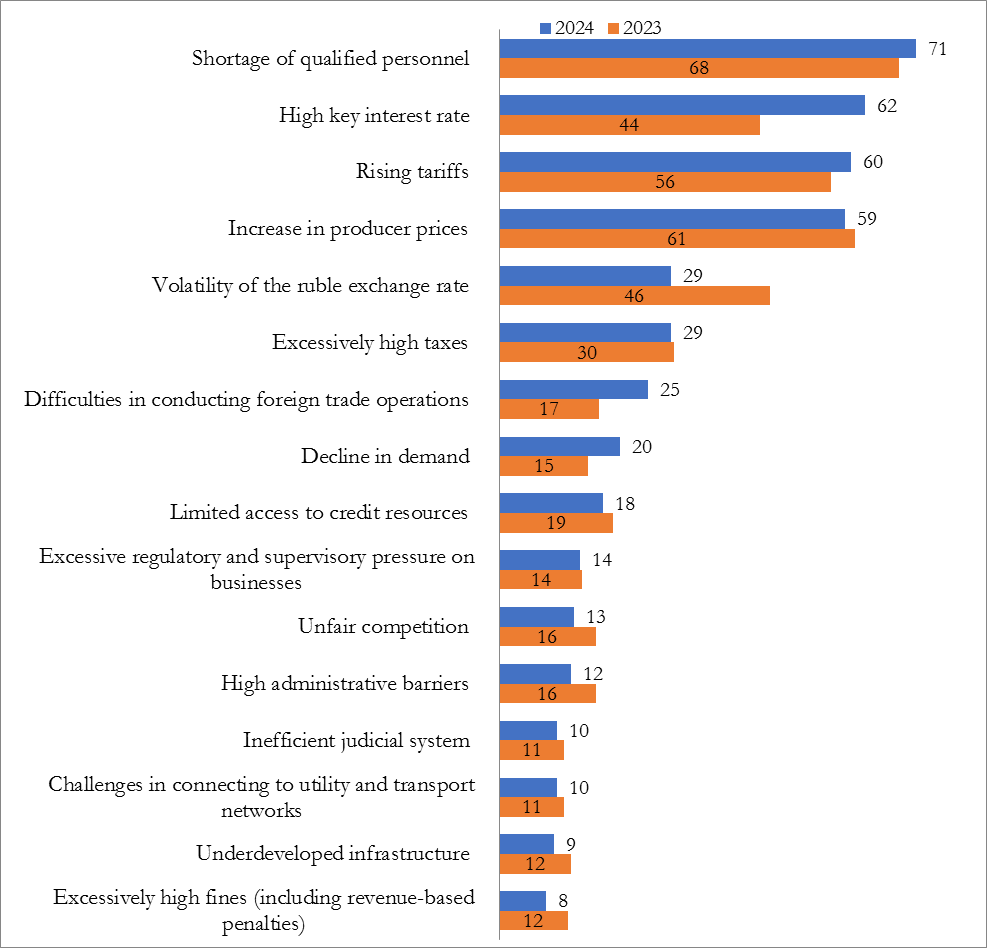

The most pressing issue for Russian businesses remains the shortage of qualified personnel, as reported by 70.1% of respondents.

The second major challenge, highlighted by 62.1%, is the high key interest rate. The relevance of this issue has surged over the past year — in the previous reporting period, it was mentioned significantly less frequently (44.2%).

Rising tariffs and increasing producer prices were cited by a similar number of survey participants, placing these problems in third place among the main obstacles for businesses in Russia.

The next two issues were excessively high taxes and the volatility of the ruble exchange rate. Respondents mentioned these significantly less often, with a combined share of 29.1%. The instability of the ruble exchange rate has become a slightly lesser concern compared to 2023, when this issue was noted by 45.9% of businesses.

A quarter of respondents identified difficulties in conducting foreign trade operations (logistics, settlements, insurance, etc.) as a key problem. In contrast to other issues, the relevance of this challenge has increased significantly — the share of this response rose by approximately 10 percentage points.

One-fifth of respondents believe that declining demand is limiting the operations of Russian companies. Slightly fewer businesses (17.5%) cited difficulties in accessing credit as a major obstacle.

13.6% of organizations listed excessive regulatory and supervisory pressure as a key challenge, while around 12% of respondents selected "unfair competition" and "high administrative barriers."

Approximately one in ten companies complained about an inefficient judicial system, difficulties in connecting to utility, transport, and other infrastructure networks, and underdeveloped infrastructure in general.

Somewhat less frequently (7.8%), businesses mentioned "excessively high fines for violations, including turnover-based penalties" and "insufficient protection of property and contractual rights."

The Most Critical Problems Hindering Business Activity

in Russia (2023–2024), %

The survey allowed multiple responses, so the total does not sum to 100%.

Figures are rounded to whole numbers.

Only responses exceeding 10% in 2023 are included.

6.3% of surveyed enterprises cited poor-quality public administration as a problem, while 5.3% pointed to corruption in government bodies.

Fewer than 5% of respondents selected "risks of asset nationalization," "lack of clear national development goals," "inefficient tax administration," and "tightening environmental regulations."